Table of contents

Payment is becoming more cashless than ever now as a massive number of transactions are digitally carried out through credit cards and e-wallets. These methods can simplify payment as well as minimize fraud and mistakes for both businesses and consumers. In the world of e-commerce and Magento where cashless payment is prominent, many third-party financial institutions have released numerous gateways for merchants to accept credit card payments from customers. But since there are so many good options, you must have a headache choosing the right one. Luckily in this post, we’ve hand-picked the 7 best payment gateways for you Magento store owners based on functions, safety, experience, and pricing.

What is a payment gateway?

A payment gateway is a technology/service that e-commerce merchants use to accept credit card payments from their customers.

In the checkout process, customers submit their payment with credit card information like card numbers, expiration dates, and security codes. Then the payment gateway will validate and encrypt it, processing directly to the payment processor.

To put it simply, a payment gateway plays the role of the middleman between a customer’s payment and the merchant’s account. It helps sensitive information to be securely transferred from buyers to sellers and banks, enabling a quick and safe checkout process. Only by that can customers trust your sites and be confident to make purchases.

How does a payment gateway work?

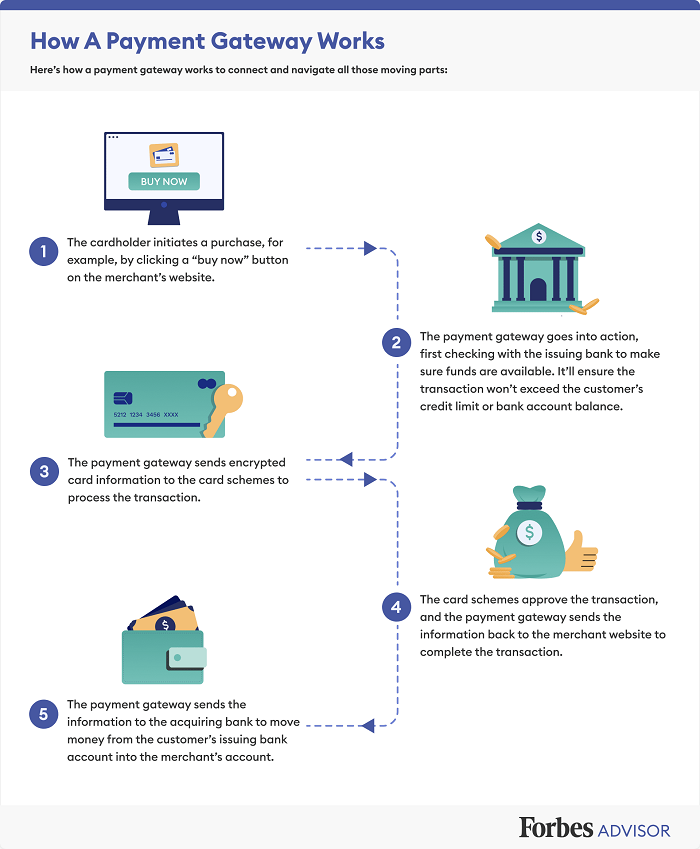

There are five key players participating in the process:

- The Merchant: online businesses or retailers that sell products/services.

- The Cardholder (customer): the customers that make purchases and payments.

- The Issuing bank: a financial institution that issues credit or debit cards to customers and holds the customer’s account.

- The Acquiring bank: a financial institution that processes card payments on behalf of a merchant and holds the merchant’s account.

- Card Schemes: a card company or payment network that connects the cards among participants (Mastercard, Visa, American Express, and UnionPay, etc.)

Here is a brief and easy-to-understand map of how a payment gateway works.

Criteria for choosing a payment gateway

Before finding out the best payment gateways for a Magento store, you need to know some criteria used to evaluate an option.

Transaction Security

Regardless of any payment method, security or safety must be the highest priority. Using online payment gateways means you trust all of your private financial information to a third party. Therefore, whichever you opt for, be assured that the chosen gateway is level-1 PCI-DSS compliant, the highest level of data protection.

And abandon the gateway immediately whenever you spot a sign of fraud or information leakage, or else, not only you won’t receive the money but also the customers will turn their back on you.

Payment Capabilities

The payment capabilities refer to how many different types of payments a gateway can support. With more alternatives offered to customers, the better it is to go after. But at least the payment gateway should accept credit or debit cards and mobile payments. As an international environment, it’s better for the gateway to be able to handle multiple currencies and card schemes from Visa, Mastercard, and UnionPay to American Express.

Convenience in integration and using

Surely when trusting a third party to support a payment gateway, you don’t expect it to be hard to integrate and function. Also, the interface and process should be simple and easy for customers to use. This can avoid discouraging them from finishing the checkout and helps get the money into your account quicker.

Cost

Usually, any payment gateway would charge you an extra fee for their services monthly. Besides, there are initial setting-up fees and fees on each transaction. These are the main fees and there might be other ones depending on the gateway. So make sure you’re clear of all the fees and do not let the costs be too excessive and cause you loss.

Scalability

A good payment gateway is one that can handle a high volume of transactions when your business grows. The Magento enterprise edition includes both small and established businesses, while the Magento community edition is restricted to small or start-up e-Commerce businesses only. Given that the majority of Magento payment gateways do not support the enterprise edition, you’d better select one that can support both.

7 best payment gateways for Magento

1. PayPal

Undoubtedly, PayPal is the leading player in e-commerce payment with over 400 million accounts from both customers and merchants, and even allows 26 currencies for the pro version. With this prominence, Magento merchants can benefit so much from it. PayPal accepts credit payments from Mastercard, Visa, Venmo, and American Express as well as mobile payments and online invoicing. It is also considered one of the most trusted gateways for Magento due to its high security against an enormous user base.

Region: Global

Fee:

- The subscription fee is $30 per month for the PayPal Pro version

- Per-transaction fee: 2.90% + a fixed fee of $0.30 for the US or 0.35 EUR for Europe, domestically.

- For international transactions: an additional fee of 1.5%.

Pros:

- Supports several card schemes and accepts 26 currencies

- Have measures to reduce chargebacks, fraudulence, and customer complaints

- Highly reliable security

- Allows creating and sending customized invoices

- Easy to set up with no fees

- A 180-day free return policy for customers

- Fast account authorization

- Level-1 PCI-compliant

Cons:

- The simple setup may attract scammers

- Unsuspending your account can be hard and take a long time

- Transaction fees may be high (if you have an increased monthly sales volume)

Integration: you can see the guide to making integration in the Magento admin panel here.

2. Braintree

Powered by PayPal in 2007, Braintree is also one of the most well-known payment gateways. This full-stack platform is widely used in over 45 countries and supports more than 130 currencies. Not only providing a seamless checkout experience and setup simplicity, but Braintree also offers additional features such as data encryption, fraud prevention, and recurring billing. Even better, it introduces a stand-alone solution called Braintree Marketplace that grows alongside your company. This strengthens the fact that Braintree is suitable for businesses of all sizes. This payment gateway can be configured directly and easily in the Magento admin panel.

Region: Global

Fee: 2.9% (per transaction) + $0.30 (per transaction), just like PayPal.

Pros:

- Hosted Fields tool that allows for the creation of any complex and unique checkout experience

- 130 currency options available for 45 countries worldwide.

- Ensures a smooth checkout with the Drop-in UI

- Offers features such as fraud prevention tools or recurring billing…

- Level-1 PCI-compliant

- Supports recurring billing.

- Supports 3D Secure

Cons:

- Fees on partial refunds are not returned

- Less user-friendly control panel.

Integration: you can see the guide to making an integration in the Magento admin panel here.

3. Stripe

As one of the leading payment gateways, Stripe is an all-in-one platform featuring over 100 currencies and is available in 25 countries. It enables recurring payment subscriptions for users, setting up a marketplace, mobile payment, one-click checkout, and of course, accepting payments from a variety of card types. Stripe is renowned for its customizability and scalability as Magento merchants and their software engineers can configure to change the gateway features corresponding to the business sizes and requirements. It takes some programming expertise to integrate this payment gateway with Magento, therefore an extension compatible with your existing store can help.

Region: Global

Fee:

- 2.9% (per transaction) + $0.30 (per transaction).

- No setup or monthly fees

- +1% for international transactions

Pros:

- One-click checkout available

- No extra fees are charged for integration; no monthly fees, set-up fees, minimum charges, or card storage fees

- Provides in-app payment integration for Android and iOS.

- Provides advanced reporting

- Development opportunities with access to modify the code

- Allows mobile payment

Cons:

- Not provide 3D secure

- Higher level of customization, a higher charge

Integration: with Stripe’s module or other extensions from providers like Mageplaza, Amasty, Webkul, etc.

4. Authorize.net

Founded in 1996, Authorize.net is among one of the longest history and most reliable payment service providers. Being affordable, secure, and easy to use, it is popular for small and medium e-commerce businesses with more than 430,000 merchants. What makes Authorize.net stand out from PayPal and Stripe is the straightforward interface and convenience in usage. This gateway supports all kinds of cards as well as e-wallets like Apple Pay and Google Pay. It can even offer a virtual point-of-sale (POS) system if store owners need it. And just like PayPal and Braintree, Authorize.net can be configured in the Magento admin panel.

Region: Global

Fee:

- With a merchant account: $25 (monthly gateway) + 2.9% (per transaction) + $0.30 (per transaction);

- Without merchant account: $0.10 (per transaction) + $0.10 (daily batch).

Pros:

- Developed a free mobile app

- Simple checkout functionality and serves both mobile and online payment

- Processes payments through both credit and debit cards and e-wallets

- Free 24×7 support is available

- User-friendly interface

- Help prevent fraud and store data securely and properly

- Custom digital invoicing feature to send invoices by email addresses

Cons:

- The mobile app is still not well-developed

- Required to create a merchant account besides the Authorizze.net gateway

Integration: recommended to use extensions from providers such as Rootways, Meetanshi, MageDelight, Creative Minds, etc.

5. Amazon Pay

Launched in 2007, Amazon Pay has become a useful tool and an indispensable part of the Amazon platform. It offers users a secure and streamlined checkout experience with a fast and high-security payment solution. Customers won’t have to create another account as it allows them to make all the transactions and transfer information by just using their Amazon accounts. Moreover, they can stay on Amazon Pay to complete transactions without leaving the site and returning to it. This enhances the shopping experience and keeps customers to stay in the website. Amazon Pay is also available in 5 different languages and supports 12 leading currencies. It provides two services for businesses which are Checkout by Amazon (CBA) and Amazon Simple Pay (ASP). Magento store owners can enable a Pay with Amazon button in the admin panel as well.

Region: Global

Fee:

- 2.9% (per transaction) + $0.30 (per transaction)

- 3.9% + 0.3% per transaction for outside US cards

- No setup or monthly fees

Pros:

- On-site completing transactions using only one account

- Can integrate with your existing CRM systems

- Offers 2 services for business: ASP (Amazon Simple Pay) and CBA (Checkout by Amazon)

- Fraud detection system

- A rich toolset of features

- Improved checkout experience and reduced cart abandonment rate

Cons:

- Support fewer languages and currencies than other payment systems

Integration: set up Amazon Pay in the admin panel guide here.

6. 2CheckOut (now Verifone)

Supporting 87 currencies and more than 30 languages, and accepting all the major payment methods, 2Checkout is listed among the best payment gateways for Magento for over 50.000 retailers worldwide. It allows merchants to bill customers for a monthly subscription, integrate with over 100 shopping carts, and keep track of payment history. 2CheckOut has more than 300 fraud rules and numerous security-guarantee standards, including PCI DSS Level 1, GDPR, BBB Accreditation, and Privacy Shield. Especially, store owners can have extra space for order storage because shopping cart information can be stored on the 2CheckOut hosted page.

Region: Global

Fee: 3.5% (per transaction) + $0.35 (per transaction).

Pros:

- Highly certified security to protect customers and store owners from fraud

- Multiple localized payment options and recurring transactions

- Wide coverage of payment methods.

- 24×7 customer support.

Cons:

- It can be difficult to switch the withdrawal method for payments.

- The fee is a bit higher

Integration: Download the 2Checkout Payment module from GitHub and follow the guidance here.

7. WorldPay

WorldPay is also one of the most popular payment service providers worldwide. Over 400,000 merchants from 40+ countries use it and are estimated to make about 26 million daily transactions. It offers a variety of payment options from regular billing and virtual terminal pay to a pay-per-link feature. With WorldPay’s hosted payment page and WorldPay payment extension, customers won’t have to leave the site when completing transactions. This payment gateway is suitable for businesses of any size and type with reporting and up-to-date fraud protection tools. WorldPay even enables WorldPay e-Wallet payment, Worldpay local card scheme payment, and Worldpay vault for card saving and admin orders.

Region: Europe

Fee: from 19 GBP (for the Gateway Standard) | from 45 GBP (for the Gateway Advanced) per month

Pros:

- Smooth checkout with on-site payment

- WorldPay manager tool for reports, information, and insight management

- Powerful security methods (encryption and tokenization)

- Expert Guidance

- 3D secure services

Cons:

- Large transfer delays

- Higher fees for smaller businesses

Integration: see setting up by Worldpay account guidance here.

Conclusion

To sum up, payment can be seamless and trouble-free when you use the correct payment gateways for your Magento stores. However, it is hard to choose one that ticks all the boxes. Each payment gateway serves different needs and has its pros and cons. So evaluate thoroughly all the alternatives and make sure the right one meets the requirements of your business.